views

Go Touch-Free with Credit Card Processing Solutions

The world has changed a lot since the first encounter of Covid-19. The Post-Covid era brings forth a new age that is touch-free.

People are going online for their every need due to the fear of the coronavirus. Therefore, Online Credit Card Processing holds a firm ground in this era.

It offers a business to go with the trend. Being Touch-Free is the new mode of payment. Online transactions are adding to the contactless way of payments.

The brick-and-mortar shops have a POS or Card Terminal to process the payments.

However, online card payments need a Payment Gateway to process the payments.

Debit or credit card falls under specific card schemes such as VISA, CUP, AmEx, MasterCard, etc.

You can get credit card processing from the card schemes. However, it will only allow you to process a particular type of card scheme.

In other words, VISA credit card processing will only help you to process VISA cards.

However, with a payment gateway, you have several benefits. It allows you:

Payment Gateway is shaping the Post-Covid situation around the world. As lockdowns stopped the course of physical stores, they opened new windows to eCommerce. People started getting everyday groceries other than the typical online products such as electronics.

Therefore, eCommerce Payment Gateway pushed the barriers far away. Moreover, with the savings on the line, people turned to credit cards for payments.

“…credit cards now make up 82.1% of all retail (in-store) transactions in the U.S. amid coronavirus…”

(CNBC)

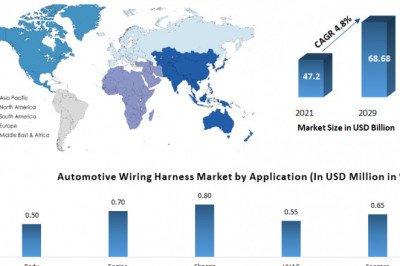

It changed the course of credit cards around the world as well. Therefore, the demand for credit card processing through a payment gateway has increased.

A payment gateway is a payment processing channel that allows consumers to pay securely. The payment service providers provide it with various features.

It will be a significant value to your business as you can process credit cards and debit cards. Moreover, you will have various modes of payment along with it—eCheck, ACH, eWallets, Net Banking, Cryptocurrency, and much more.

Therefore, it marks a great start to expand your business worldwide.

More features of a payment gateway add value to your business. Some of the features are:

Now that you know about the payment gateway, you must be thinking about getting one for your business.

A PSP or Payment Service Provider provides a payment gateway service.

A business can be classified into three categories depending upon the risks. It may be Low, Medium, or High-Risk Business.

Getting a payment gateway for the Low and Medium Risk business is easy. The conventional service providers will offer you tonnes of opportunities.

However, the problem comes in for the High-Risk Businesses. They need a High-Risk Payment Gateway Provider for their business.

Service Providers such as eMerchantPro offer the best services to high-risk businesses. They are dedicated payment service providers for the sector.

Hence, your business can get a channel to process online card payments seamlessly.

A Payment Gateway is a RegTech that complies with all the security standards inexpensively.

eMerchantPro offers a payment gateway service to your high-risk business for credit card processing.

Post-Coronavirus will be a serious practice of paying through online modes.

Moreover, a Credit Card Processing tech on your website allows you to expand your business significantly.

Credit and Debit Cards have always been a preferred mode of payment. Therefore, allowing the consumers to pay on your website allows your business to expand your business reach.

We also provide complete merchant assistance to merchants. Allows you to get all your demands met. You may need more features to be integrated into your payment gateway.

Therefore, we shall be delighted to hear from you. Get a Callback Today!

Comments

0 comment